MMM - Why “Pay Off Debt” vs “Invest More” Misses the Point

There are two camps in personal finance:

Camp 1: Never pay off debt if your investment return beats your interest rate.

Camp 2: Pay off debt as fast as possible.

Both sides swear they’re right.

Both sides miss the real point: risk.

Camp 1 works because your return should exceed your borrowing cost.

But those higher returns only exist because you’re taking on more risk.

As your leverage grows, the house of cards gets taller — and the fall gets a lot uglier when something goes wrong.

Camp 2 works because paying off debt reduces risk.

Lower debt = lower stress = fewer ways for life to punch you in the face.

But here’s the flaw:

Playing only defense keeps you safe - and stuck. You don’t build wealth that way.

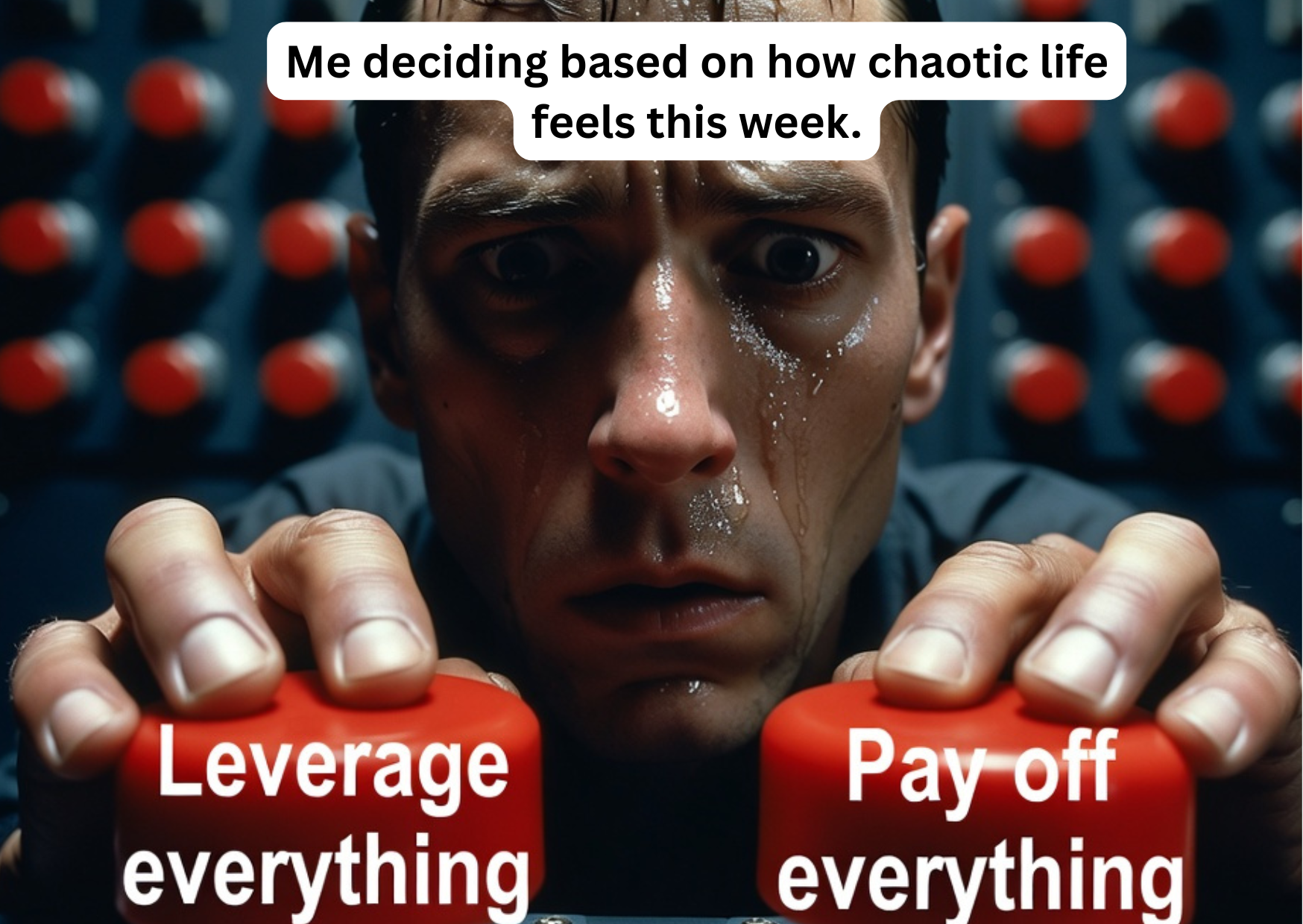

I don’t pick a camp.

I move between them depending on my risk and the season of life I’m in.

When opportunity is high and risk is manageable → I lean into leverage.

When leverage stacks up and things start feeling fragile → I de-risk.

Not because debt is bad.

Not because investing is good.

But because risk changes, and your strategy should too.

Wealth isn’t “leveraged forever” or “debt-free forever.”

It’s knowing when to push and when to pull back.